CQT researchers to collaborate with OCBC on quantum computing

CQT Principal Investigator Patrick Rebentrost will lead a project with the Singapore bank on using quantum computing for derivative pricing

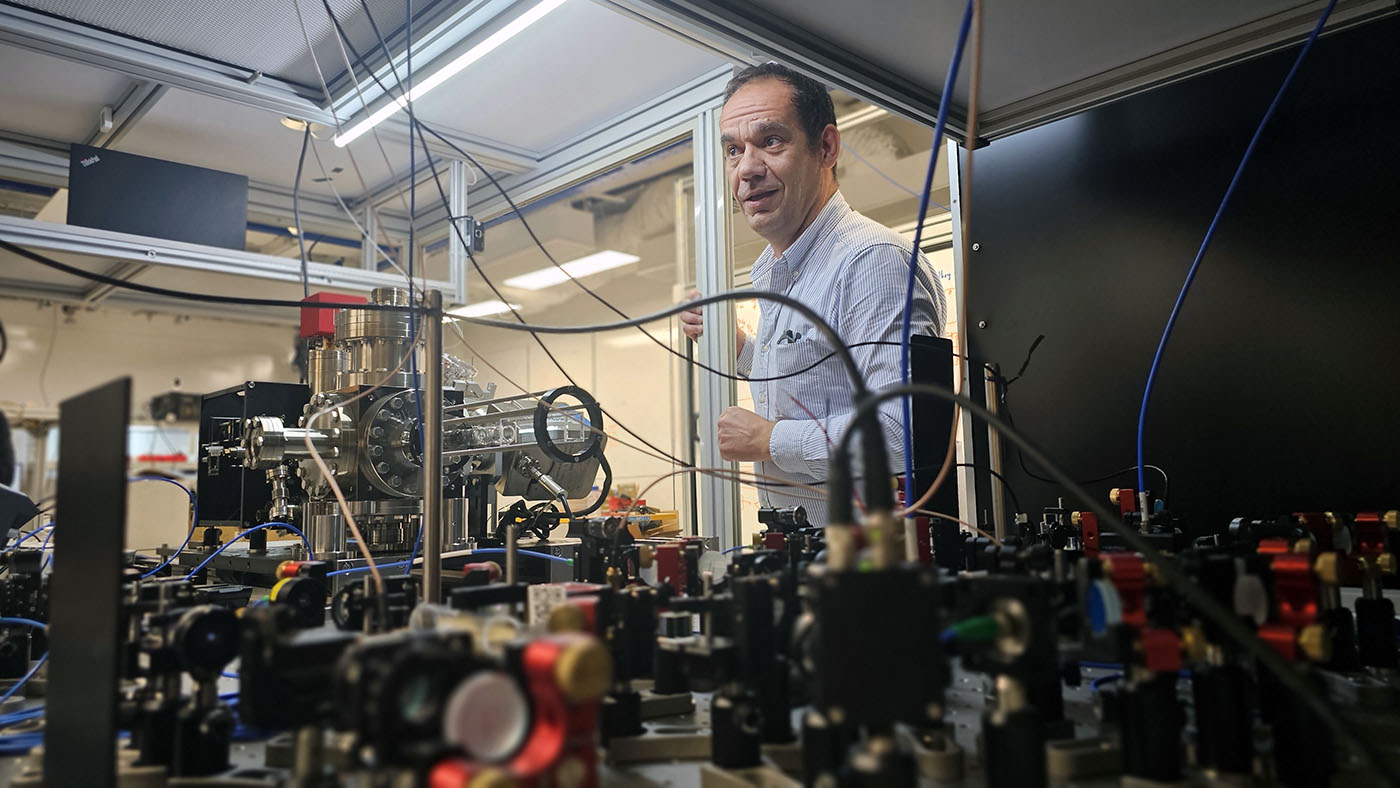

OCBC announced quantum research collaborations with the National University of Singapore acting through CQT, Nanyang Technological University, Singapore, and Singapore Management University. CQT Deputy Director Valerio Scarani (second from right) attended the signing event. Image credit: OCBC.

CQT researchers are set to collaborate with Singapore bank OCBC under an agreement signed between the bank and the National University of Singapore (NUS), OCBC announced on 17 July. The 12-month long research collaboration investigates use cases for quantum computing in finance.

Quantum computing promises to solve some problems beyond the reach of today’s supercomputers more efficiently. Finance is one field where researchers expect quantum computing to make an impact.

Monte Carlo simulations

In particular, CQT’s collaboration with OCBC looks to leverage quantum computing to accelerate Monte Carlo simulations – a widely used technique in financial derivative pricing. By harnessing quantum algorithms, these simulations have the potential to be executed significantly faster and with greater precision, enabling near real-time portfolio rebalancing and complex risk modelling.

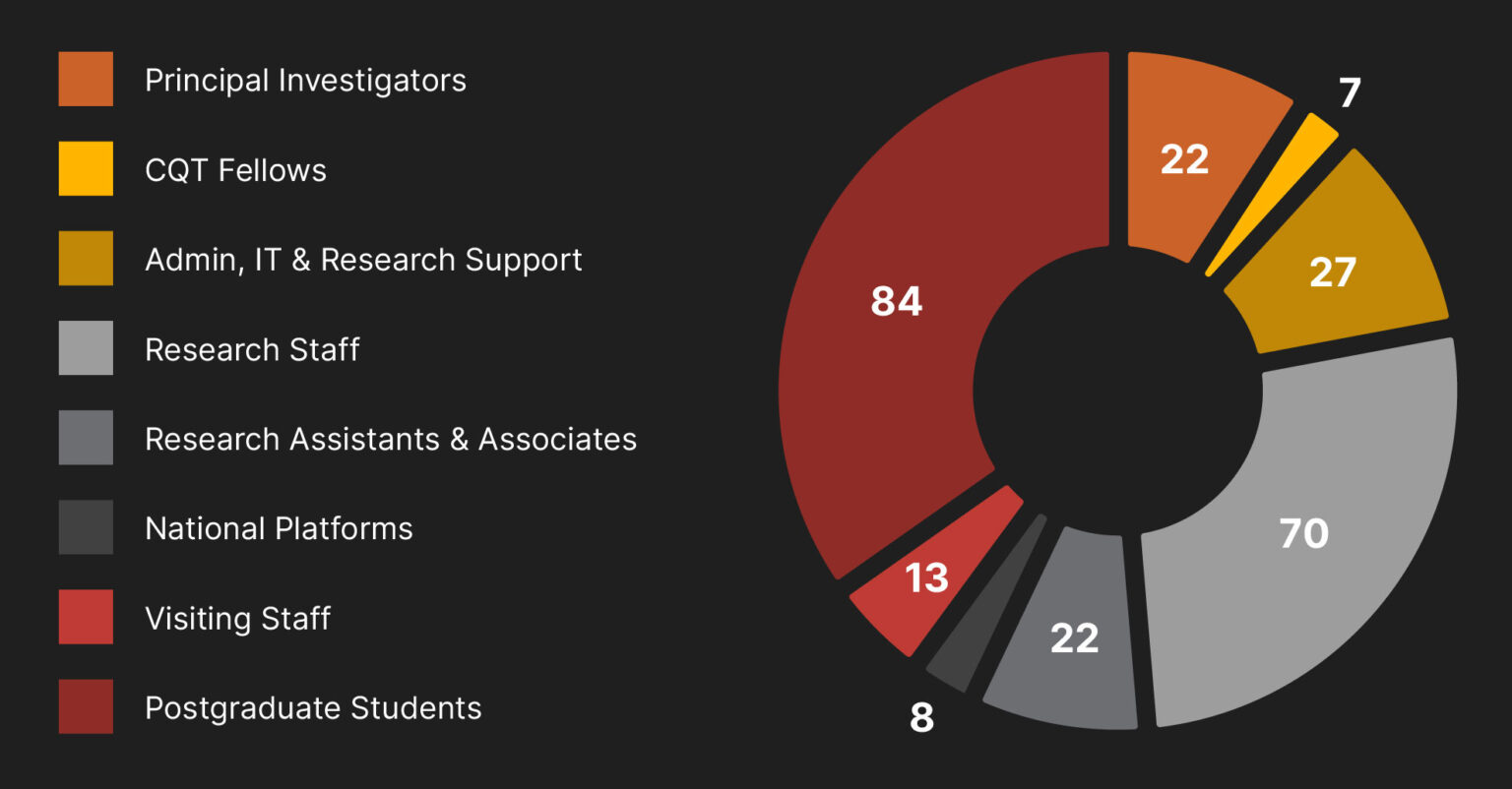

The project will be led by CQT Principal Investigator Patrick Rebentrost. “While my academic group has a deep understanding of the interface of quantum algorithms and mathematical finance, this project with OCBC gives us the opportunity to apply the theory in practice,” said Patrick, who is also co-appointed as Assistant Professor at the Department of Computer Science at the NUS School of Computing.

“In close collaboration with the team at OCBC, we are taking substantial steps towards the realisation of quantum algorithms for the pricing of complex financial derivatives. The project will further illuminate the potential and challenges for quantum computing in a real-world finance context.”

OCBC has also worked with CQT through the National Quantum Computing Hub on training its staff. The Hub’s QuTalent team conducted training sessions focused on equipping participants from the bank with an understanding of quantum algorithms and their applications in finance.

Industry-academia exchange

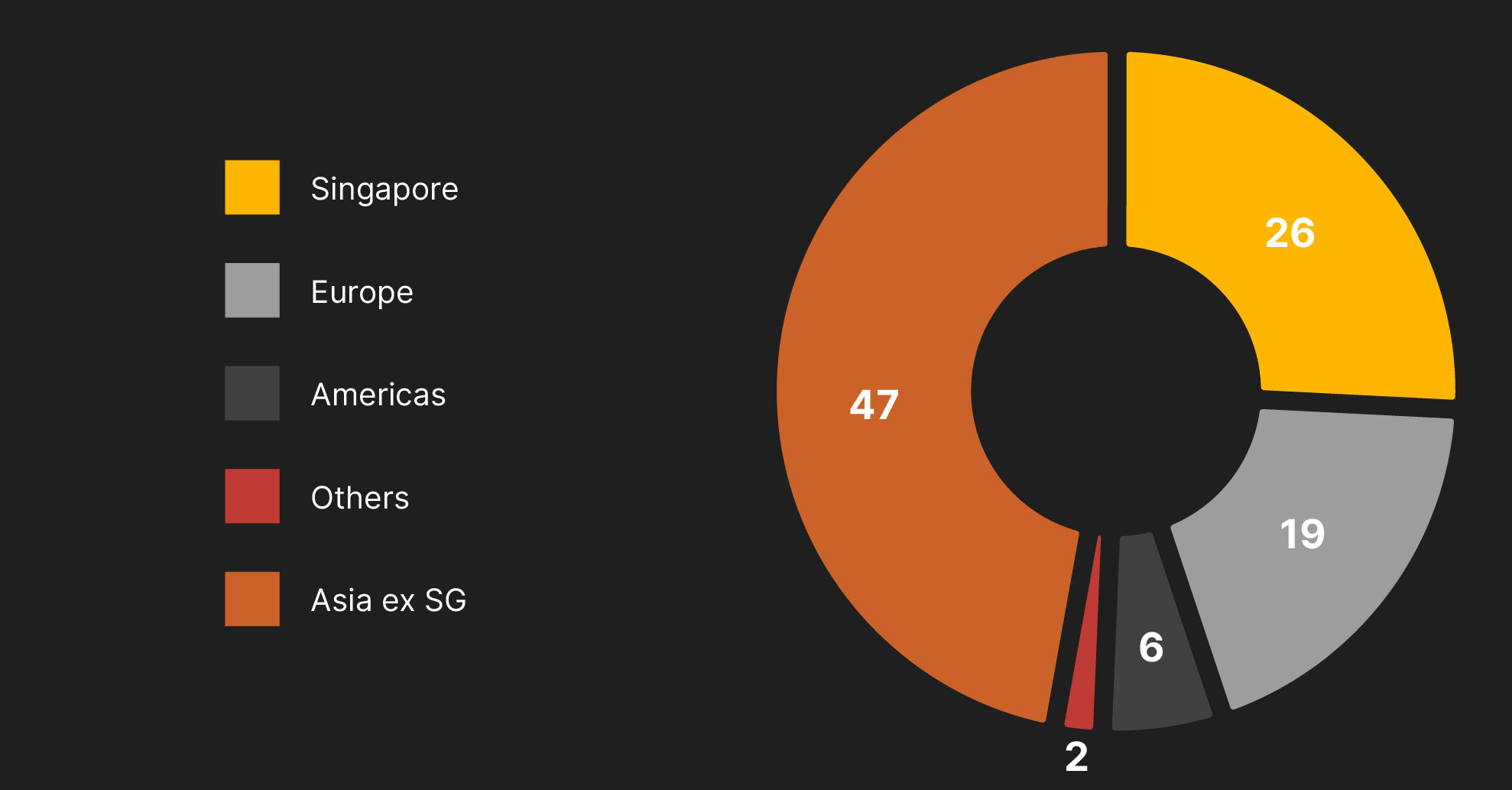

At the same time, OCBC announced two other collaborations with the Nanyang Technological University, (NTU Singapore), and Singapore Management University (SMU). The collaboration with NTU will deploy post-quantum cryptography to enhance data security while the collaboration with SMU will apply quantum machine learning techniques to enhance fraud detection capabilities.

Mr David Koh, Chief Quantum Advisor and Chief of Digital Security and Technology at the Ministry of Digital Development and Information, and Chief Executive of the Cyber Security Agency of Singapore, witnessed the signing of the research collaboration agreements with NUS, NTU and SMU.

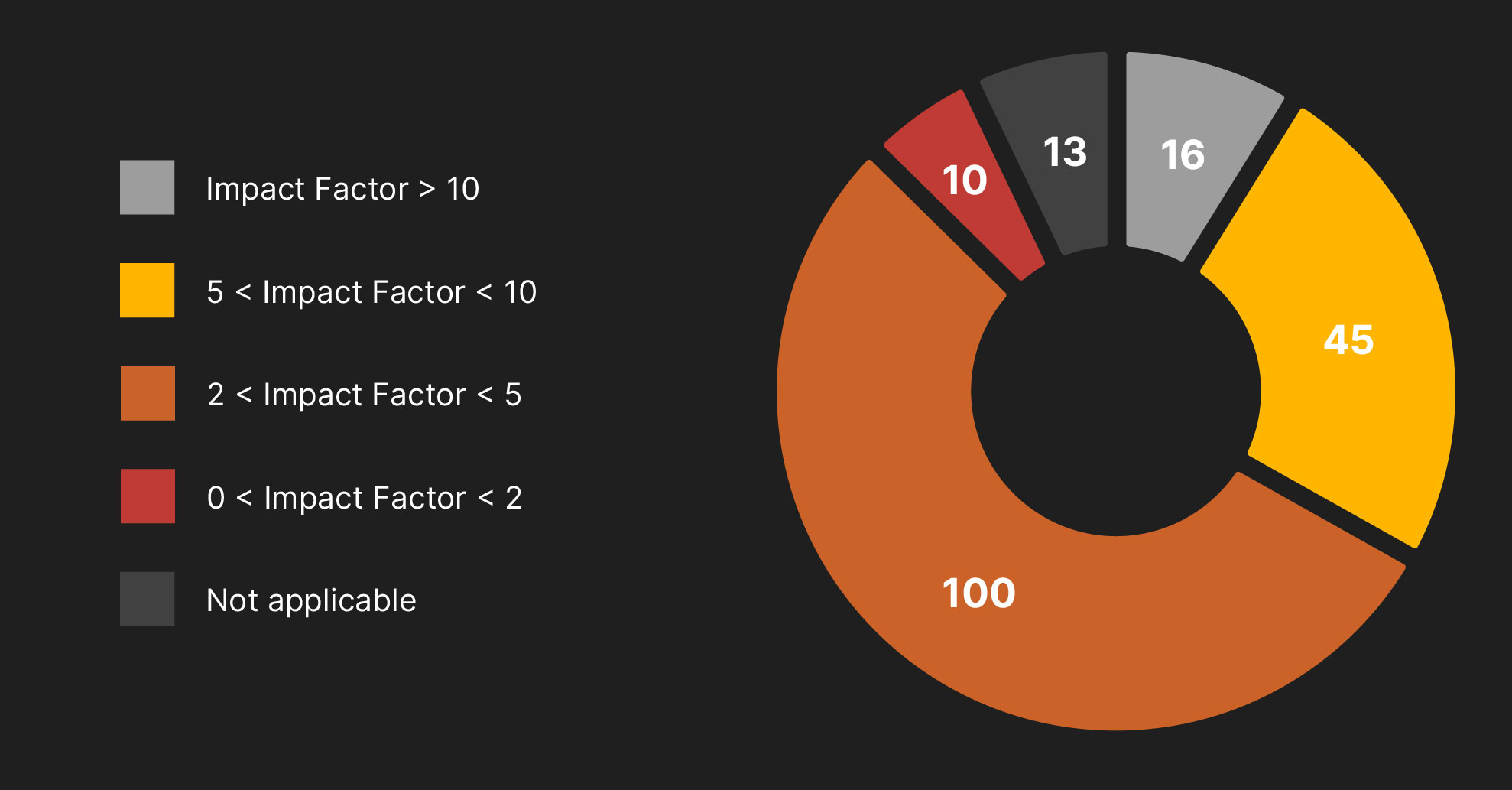

Findings from the collaborations will be published in technology-focused research papers and journals, benefitting the financial industry. This will enable the banking sector to assess the suitability of applying quantum technology to key banking operations and potentially accelerating the adoption of this technology.

Mr Praveen Raina, Head of Group Operations and Technology at OCBC, said, “The industry-academia exchange is deeply meaningful to us. It drives research and innovation by merging practical insights and real-world use cases with domain expertise and knowledge. By working closely with NUS, NTU and SMU, in addition to our existing partnerships with key ecosystem players, we bring the reality of innovative quantum applications and solutions closer to life than before. This collaboration also illustrates how we are taking bold, proactive steps to test emerging technologies, even when their commercial potential is still unfolding.”

This story is adapted from a media release issued by OCBC on 17 July 2025. The bank also released a video after the signing event, which can be watched here.

Selected media coverage: